How do I temporarily lift a credit freeze? You will need your personal identification number to unfreeze your Experian credit report. You have to unfreeze your credit with each credit bureau individually, unless you know which credit bureau a creditor is using and choose to lift your credit freeze at just that one. Question about Experian membership accountĭo I have to unfreeze all three credit bureaus to apply for credit card?

Temporarily lift experian credit freeze how to#

How to Speak With a Real Person at ExperianĬall the number on your document from Experian The number (888) 397-3742-6 (1-888-EXPERIAN) will also work….How to Talk to a Real Person at Experian. How do I speak to a live person at Experian? You can check the status of your security freeze through your myEquifax account as well.

You can log in to your Experian account to manage your security freeze online and ensure the security of your credit file. We have implemented a newly enhanced authentication protocol for security freezes so that you no longer need a PIN to freeze or unfreeze your Experian credit file. How do I unfreeze my Experian account without PIN? Simply create an Experian account to log in to your Experian membership and untoggle your freeze. If your Experian credit file is frozen and you need to apply for credit, you can lift the freeze at Experian’s Freeze Center. How do I unlock my frozen Experian account? But you also have the option to contact them by mail.

Temporarily lift experian credit freeze password#

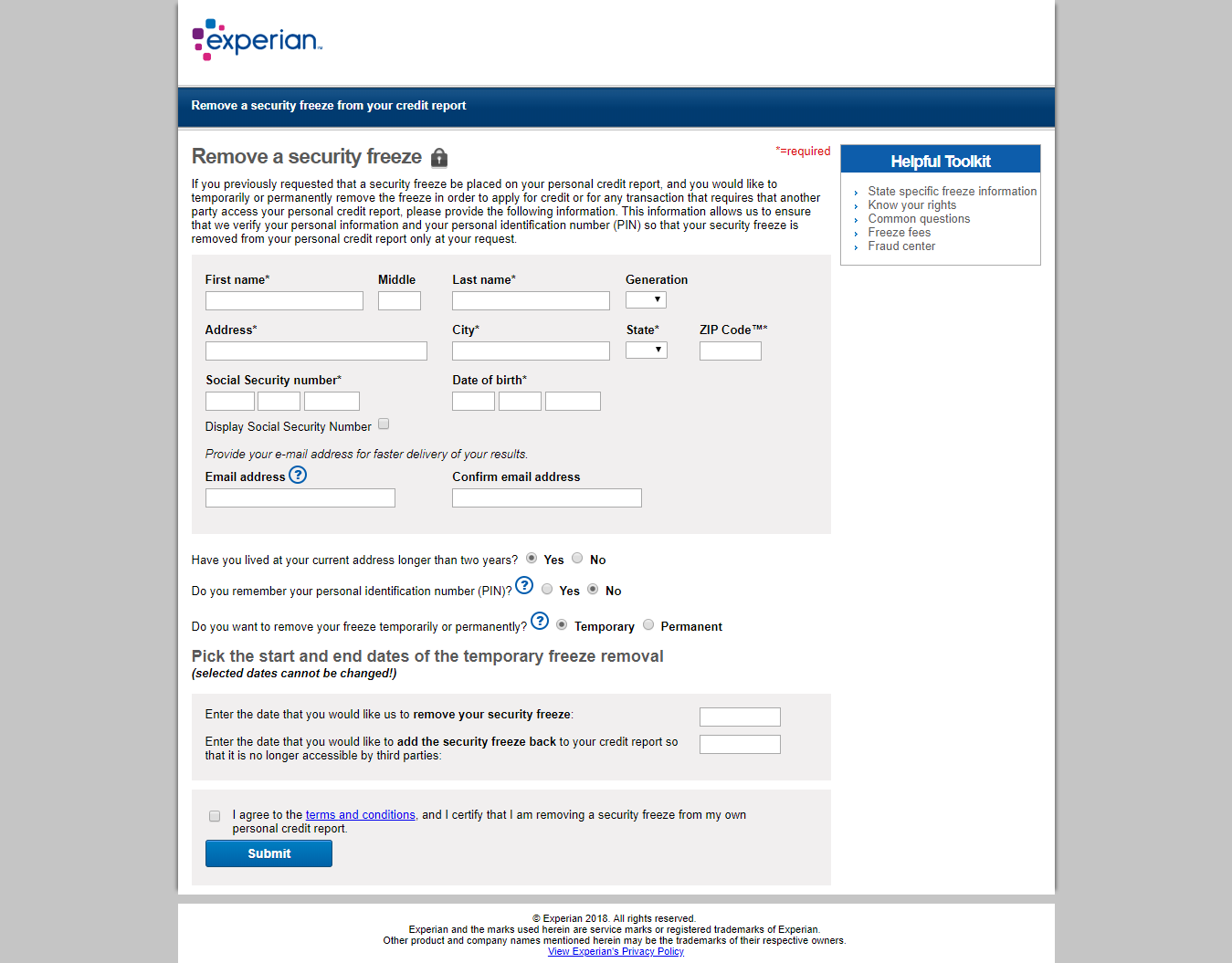

Expect a credit reporting agency to remove or lift the Security Freeze for a party to receive a report within three business days of your request provided you submit proper identification, your password or PIN and payment of any applicable fee.Ī consumer reporting agency is permitted to charge consumers who are not victims of identity theft a fee of up to $5 for the removal or lifting of a Security Freeze, the second or subsequent placement of a Security Freeze or the replacement of a lost password or PIN.Use the password or PIN to temporarily lift or permanently remove your Security Freeze.Expect a password or Personal Identification Number (PIN) in confirmation letter from each of the credit reporting agencies which must be sent within 10 days of placing the Security Freeze.Allow five business days upon receipt of your request for the credit reporting agencies to place a Security Freeze on your credit file.Send a certified letter, with proper identification, to each of the three nationwide credit reporting agencies: TransUnion, Experian and Equifax.The consumer will have to allow time for the credit reporting agency to temporarily lift or remove the freeze and “ thaw” the record for an authorized user.

However, with a security freeze in place, a consumer may not be able to secure instant credit, insurance coverage or other benefits. With a security freeze activated, if an identity thief attempts to apply for credit or a loan in a consumer’s name, the creditor or lender would not gain access to the consumer’s credit file and consequently would not approve the new application. As of November 1, 2006, New Yorkers who are concerned that they are at risk of having their identities stolen or have become victims of identity theft can block a thief’s access to their lines of credit by placing a security “freeze” on their credit report.

0 kommentar(er)

0 kommentar(er)